The Swiss IT landscape is on the way to multi-cloud – but not as fast as people thought two years ago. Many applications today are entrusted to the public cloud and multiple providers. Others are brought back to their own data center.

IT used to be a lot easier. That’s not really true, but at least it was always clear to everyone where the data lived: on their own hardware mostly somewhere in the basement. That changed with the cloud. Since then, data and applications can change addresses. Today’s IT landscape, therefore, extends from its own data center (RZ) to the hybrid to the public cloud. And with the multi-cloud, the topography becomes even more complex. Because dividing the load across different cloud providers should bring the customer various advantages. Including, for example, less susceptibility to failure, more security, and a better ROI (return on investment).

The Dutch provider of data center services Interxion addressed these questions in a study in 2018. In it, the company surveyed 120 Swiss companies with an annual turnover of more than CHF 250 million. The respondents gave their assessment of where they are on the way to multi-cloud and how the status quo will change by 2020. To see if these predictions were becoming a reality, Interxion asked the same questions again. This time 150 Swiss companies took part in the study. Interxion gave the editorial team an insight into the results of the survey.

The topography of the data

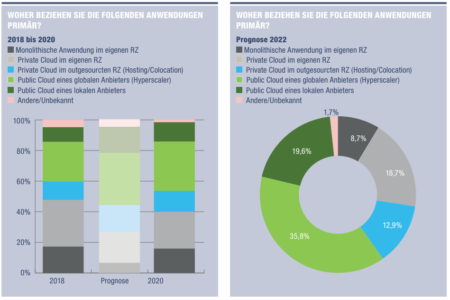

When it comes to where companies will hoard their data, i.e. on-premise, via a colocation solution, or in the public cloud, the forecasts from 2018 were correct. At least when it comes to the general trend: Everything is moving towards the public cloud.

In 2018, however, it was still thought that this journey would be much faster. Two years ago it was expected that by 2020 only 26.3 percent of the data and applications would run in their own data centers. A big step from the 47.7 percent that was still there at the time. In reality, however, the Swiss companies surveyed took a significantly smaller step. The proportion is still 39.8 percent today.

Growth in the colocation area was also lower than expected. Instead of 12 percent to 17.7 percent, the proportion rose only slightly to 13.6 percent. In 2018, those surveyed rated the run on the public cloud much better. 45 percent of Swiss companies are currently outsourcing their data and applications to a public cloud. Two years ago it was 35.5 percent. And prophesied were 51.4. In terms of the proportion of hyperscalers in particular, the forecasts from 2018 were almost spot on. According to the first study, this should be 34.3 percent today. In fact, it’s 32.2 percent according to the latest poll.

Not everything wants to go to the public cloud

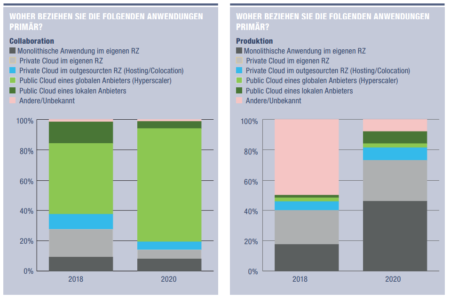

If you look at the individual application areas, you can see that each segment makes its own individual journey to the cloud. The study asked about the developments in the following application areas: ERP, CRM, supply chain management, databases with customer-specific data, databases with product-specific data, storage, back-up, project management, collaboration, HR, marketing automation, production, digital asset management, IT service management, software development/testing, and security applications.

The areas of production and – to a much lesser extent – software development/testing step out of line here. These are the only categories where the on-premise share has increased since 2018. In 2020, 73.3 percent of the companies surveyed are hoarding their production control in their own data center. Two years ago the proportion was 40 percent. This steep increase was not at the expense of the public cloud or colocation solutions. No, instead half of the respondents in 2018 gave the answer “Other / Unknown”. This proportion slumped to 8 percent in the current survey. In the software development/test area, the on-premise share also increased. However, only by 0.2 percent.

In the other categories, the public cloud is clearly on the rise. It made the most significant gains in the area of collaboration. Here the proportion climbed – probably also due to corona – from 60.8 percent in 2018 to 79.3 percent in 2020. Overall, in addition to collaboration, the areas of marketing automation, security, and software development/testing are among the pioneers in the public cloud. In all of these areas, more than two-thirds of the respondents said they store their data in the public cloud.

The other side of the coin is the categories of databases with product-specific data, production, and supply chain management. In 2020, two-thirds of the respondents will keep their data in their own data center.

Opportunities for local providers

When companies outsource their applications to a public cloud, it is not necessarily the tills of hyperscalers that ring the bell. In 2020, around a third of those surveyed stated that they rely on the services of a local public cloud provider for their HR applications – an increase of 18.5 percentage points since 2018. The hyperscalers even had to lose shares in the HR area. While their share was 27.5 percent in 2018, they only reached 24 percent in 2020. Local providers also have good cards in the areas of storage and CRM. In both areas, the majority of respondents want to entrust their applications to a local provider. Ascending trend.

Local providers who offer collaboration solutions in the public cloud should reconsider their strategy, however. Because they could not benefit from the aforementioned boom. On the contrary: their share fell from 14.2 to 4.7 percent. It was the hyperscalers who were able to increase their share by more than 50 percent. Furthermore, the areas of security, supply chain management and software development/testing are probably not very profitable for local providers. In all three, their share is in the mid-single-digit percentage range.

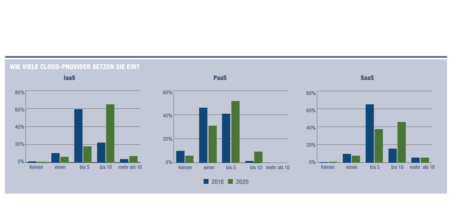

Always moving towards multi-cloud

A comparison of the studies from 2018 and 2020 shows that the Swiss IT landscape has developed more towards a multi-cloud world. Infrastructure-as-a-Service or Software-as-a-Service solutions were usually spread across up to five cloud providers in 2018. This was the answer most frequently given by around 60 percent of those surveyed. Meanwhile, the number of cloud providers increased. In the 2020 survey, “To ten” was the most frequently given answer when it comes to SaaS and IaaS solutions. Especially in the IaaS area. More than two thirds of the respondents currently rely on up to ten providers.

In contrast, Swiss companies prefer to limit their platform-as-a-service services to fewer providers. In 2018, almost half of the respondents in this category stated that they only used one provider. “To five” was given by 40.8 percent as an answer. In the past two years, this relationship has shifted slightly towards multi-cloud. In the current study, only 30 percent of those surveyed stated that they only use one provider. The proportion of those who distribute their PaaS services to up to five providers has meanwhile increased to just over half. And only 9.3 percent rely on up to ten providers.

Optimism about the multi-cloud has also increased. In 2018, 70.6 percent were convinced that they would implement a multi-cloud project by the end of 2020. In the current survey, this share rose to 74.7 percent. The proportion of respondents who answered no fell from 24.5 to 20.7 percent over the same period.

What moves the decision-makers

The reasons why the respondents opted for one of the solutions has not changed much in the past two years. Data security and the fact that companies can fall back on their own experience and expertise continue to speak in favor of on-premise solutions.

When companies opt for a colocation solution, data security is still one of the reasons. The main argument, however – in 2018 as well as in 2020 – is the cost. Compared to the first study, it turns out that the costs in the argument are losing weight. In 2020, costs and data security will be seen as almost equally important when deciding on colocation.

What if you opt for the public cloud? A clear question of costs, as the study shows. Companies still have flexibility and scalability in the back of their minds. But the topic of data security hardly plays a role here. The same applies to the argument of one’s own expertise. Only a few percent of those surveyed consider these factors to be decisive.

In the current survey, Interxion naturally wanted to know how the IT landscape will change in the next two years. The responses show that the general trends will largely persist – at least if the respondents are forecasting it. By 2020, the proportion of companies with data in their own data centers should shrink to 27.4 percent. 58.1 percent of those surveyed assume that their data will be stored in the public cloud in 2022.

But the colocation segment is turning around. In 2018 it was still thought that the proportion would increase a few percentage points. The respondents now expect the proportion to decrease slightly. And by less than one percentage point to 12.9 percent by 2022.

Original Article Source from https://www.netzwoche.ch